Taking stock and finding ways to live frugal

Taking stock and finding ways to live frugal

By Richard Davis

TFW Staff Writer

If you aim at nothing, you’ll probably hit it.

It’s a mantra Mark Foster, education director at Credit Counseling of Arkansas, likes to use for one of the major thrusts the nonprofit organization preaches regarding finances: planning.

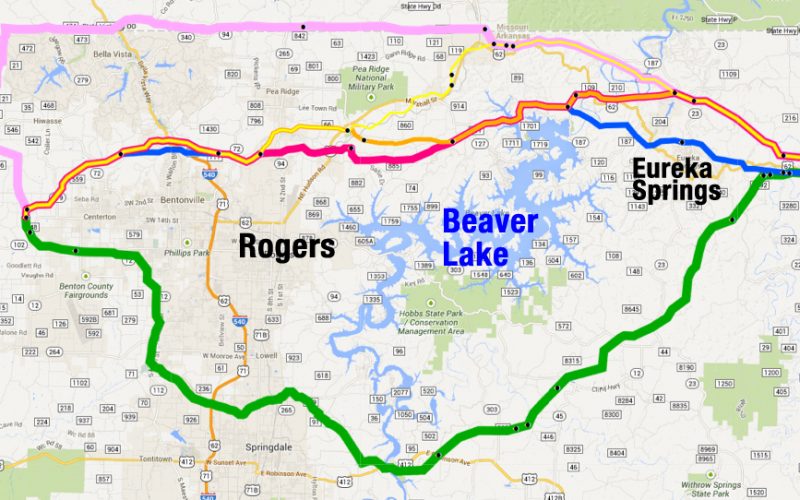

“You don’t just hop in a car and say, ‘Let’s go on vacation. Let’s go to New York,’ and start driving. You want to have a map or GPS or something to know where you’re going. And a lot of times people don’t really have but hopes and dreams that sort of pinball around in their head and they just stay there as hopes and dreams and they don’t turn into a reality,” Foster said.

“Studies show that when people write down their goals, they achieve them far more often than if they just have hopes and dreams and wishes and stuff stuck in their heads. Write them down and post them where you can see them every day.”

With Christmas just behind, it may be time for some to do what they failed to do before: Examine spending and develop a strategy for their finances. Bruce Castleberry, community outreach coordinator at CCOA, says it starts with what’s going out of your pocket, not what’s going in.

“It’s pretty difficult to change that number that comes in. You can’t just say, ‘You know, I need $5,000 more this year. Gimme a raise.’ Good luck with all that,” Castleberry said. “But the money you have going out, that you can control.”

That process begins with a diligent look at what you spend in an average month.

“Look at everything that goes, everything that you’re obligated to pay that you can’t adjust. You can’t call up the utility company and say ‘I think $100 for my gas payment this month is too much. I’ll give you $40.’ So you have to account for that,” Castleberry said. “So you take all those factors into account and look at where can you cut cost. Can you order a medium pizza instead of a large this time? Instead of going to Starbucks four times a week, can you go three times a week or two times a week?”

As Foster said, living frugally doesn’t necessarily have to mean a ban on things enjoyable, including eating out or going out to lunch at work.

“We used to go out here (for lunch), at most, once every week or two. Eventually we reduced to once a month. So we didn’t cut it out, we just scaled it back a bit,” Foster said. “Things of that nature where you can still have a little bit of your cake and eat it too, but maybe not quite as big of a slice of cake.”

Another phrase that gets repeated in the CCOA offices is “financial freedom.” This all relates to your goal. Are you looking to get out of debt? Are you hoping to start stocking up on savings? Are you simply looking for tips to reduce the amount of Benjamins, Washingtons and Hamiltons flying out of your wallet each month?

“Each case varies for each individual. We have people who come to us that are considered low-to-moderate income that earn less than $20,000 a year, and every penny that they make is important,” Castleberry said. “We’ve had people come to us with six-figure incomes that have found that’s not enough for them to live on and they’ve had to adjust their living to fit their lifestyle.”

One of the easiest things to overlook is not recognizing the changes one needs to make to their budget if they’ve been downsized, had to take a pay cut or lost hours due to a moratorium on overtime.

“Having been downsized before, the thing that I had to go home and tell my wife, years and years and years ago when I was ‘restructured,’ I told my wife we have to make some changes. And that’s the biggest thing we see people do when they’ve been downsized or maybe underemployed for a while because they’ve lost hours — no more overtime hours — or reducing your pay 10 percent or whatever it might be. The biggest mistake we see people make is they’re overly optimistic. Things’ll bounce back. It’ll get better before long. As the saying goes, ‘Hope for the best, but plan for the worst.’ So what you need to do right away is say ‘We need to make some changes. And the thing I did right away is say ‘What can we cut out?’”